The Zebra Car Insurance Reviews (2025) – Honest Breakdown, Benefits & Where to Buy

Launched in 2012, it has become a go-to tool for finding personalized quotes across multiple insurers without the hassle of contacting each one individually.

Within minutes, The Zebra presents side-by-side quotes from top providers—making it easier to compare coverage levels, pricing, and special features.

This process helps drivers save time and, in many cases, hundreds of dollars per year on car insurance. That’s where reviews, product comparisons, and real-world examples come into play.

Key Benefits of Using The Zebra Car Insurance

Convenience and Time Savings

One of the major advantages of The Zebra is how quickly users can receive personalized quotes.

Educational Support

For those new to insurance or unsure of which coverage to select, The Zebra offers articles, glossary terms, and coverage explanations to help users make informed decisions.

Real-World Examples: Car Insurance Products Found via The Zebra

Below are five real examples of insurance providers you might find using The Zebra, each with a detailed explanation of what they offer:

Known for affordable pricing and nationwide coverage, GEICO offers extensive options for drivers with various risk profiles. Many users report saving 15% or more by switching to GEICO through The Zebra GEICO’s ease of claims processing, bundling discounts, and student savings make it a favorite among young and budget-conscious drivers.

State Farm is America’s largest auto insurer. With personalized service through agents and generous discounts for safe drivers and students, it’s a great option for families and professionals.

Allstate is well-known for its Drivewise® app and broad policy features

Use Cases: What Problems Does The Zebra Solve?

Avoiding Overpaying for Insurance

Many consumers stick with the same insurer for years, often unaware they could save by switching. The Zebra solves this by making comparison easy and quick, ensuring drivers see all available options.

Helping First-Time Drivers Choose Wisely

New drivers often find the insurance market overwhelming. The Zebra provides educational content and visual comparisons to help simplify the process, making it less intimidating.

Supporting Budget-Conscious Families

The Zebra empowers families to compare and choose policies that offer essential coverage at a lower cost.

How to Buy The Zebra-Suggested Insurance

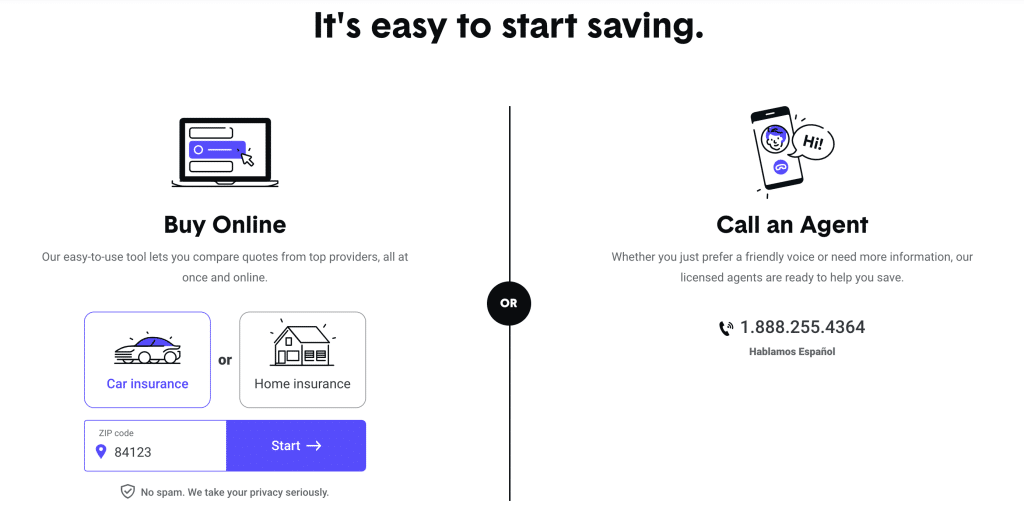

Purchasing insurance via The Zebra is straightforward:

- Visit The Zebra Website

- Enter your ZIP code and basic vehicle information.

- View personalized quotes from top insurers.

- Click on your preferred quote.

- Finalize your policy on the insurer’s official site.

Frequently Asked Questions (FAQ)

1. Is The Zebra a car insurance provider?

No, The Zebra is not an insurance company. It is an insurance comparison tool that connects users with quotes from licensed providers.

2. Is The Zebra free to use?

Yes, The Zebra is completely free. Users can compare quotes without paying fees or committing to a policy.

3. Will using The Zebra affect my credit score?

No, requesting quotes through The Zebra does not result in a hard credit check and will not impact your credit score.