Lemonade Auto Insurance Reviews: Comprehensive Analysis of Coverage, Benefits, and Customer Feedback

Lemonade has emerged as a modern insurance provider, leveraging technology to streamline the insurance process. This article provides a comprehensive analysis of Lemonade’s auto insurance services, examining coverage options, benefits, customer feedback, and comparisons with other providers to assist you in making an informed decision.Apple+10Lemonade+10Zebra Insurance Quotes+10

Understanding Lemonade’s Auto Insurance Service

Overview of Lemonade’s Platform

Lemonade offers a range of insurance products, including auto insurance, utilizing technology to simplify policy management and claims processing. The company emphasizes a user-friendly experience through its mobile app and online platform.

Coverage Options Offered by Lemonade

Lemonade provides standard auto insurance coverages, including:YouTube+20Insuranceopedia+20NerdWallet: Finance smarter+20

- Liability Coverage: Covers bodily injury and property damage to others if you’re at fault in an accident.Coverage Cat+3Insuranceopedia+3Lemonade+3

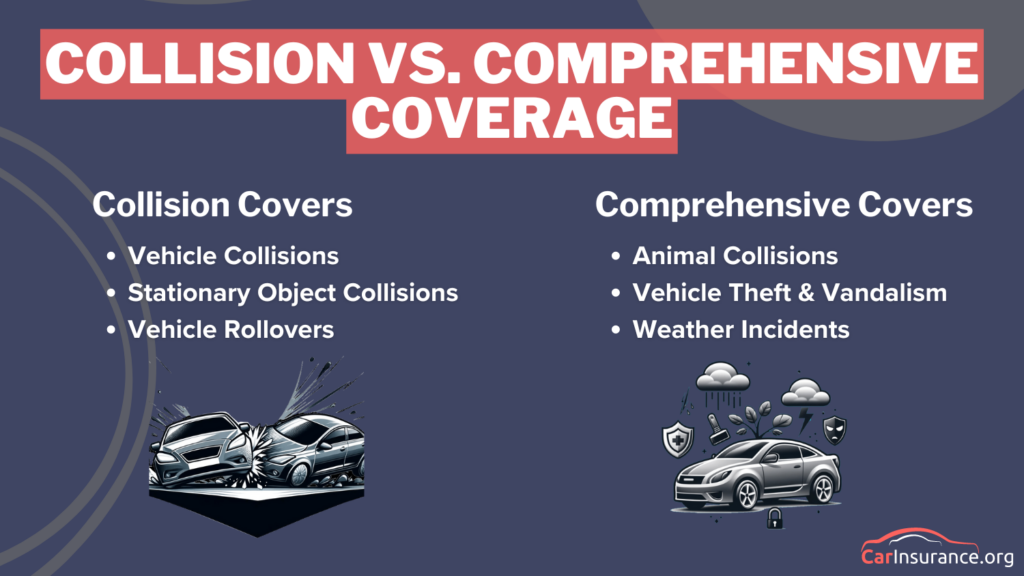

- Collision Coverage: Pays for damage to your vehicle resulting from a collision, regardless of fault.Lemonade+3Insuranceopedia+3NerdWallet: Finance smarter+3

- Comprehensive Coverage: Protects against non-collision incidents such as theft, vandalism, or natural disasters.Insuranceopedia

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault.Insuranceopedia

Technological Benefits of Lemonade’s Auto Insurance

AI-Powered Claims Processing

Lemonade utilizes artificial intelligence to expedite claims processing, aiming to provide quick resolutions and enhance customer satisfaction. Clearsurance+4Insurify+4Lemonade+4

Telematics and Personalized Pricing

The company employs telematics to assess driving behavior, offering personalized pricing based on factors such as mileage and driving habits. This approach can lead to cost savings for safe and low-mileage drivers. Autoinsurance.com+3Bankrate+3Lemonade+3Lemonade

Customer Experiences and Satisfaction

Positive Feedback

Many customers appreciate Lemonade’s user-friendly app and streamlined processes. The company’s innovative approach and commitment to social good have also garnered positive attention. YouTube+14Lemonade+14Insurify+14

Areas of Concern

Some users have reported issues related to policy coverage and claims processing. It’s essential for potential customers to thoroughly review policy details and understand the terms and conditions. Better Business Bureau

Comparing Lemonade to Other Auto Insurance Providers

When evaluating auto insurance options, it’s beneficial to consider how Lemonade stacks up against other providers:

1. Metromile offers pay-per-mile insurance, appealing to low-mileage drivers

Metromile offers pay-per-mile insurance, appealing to low-mileage drivers. Their model focuses on charging customers based on the actual miles driven, which can result in significant savings for those who drive less frequently. Zebra Insurance Quotes+2Metromile+2Lemonade+2

2. Root uses telematics to assess driving behavior and offers personalized rates based on individual driving habits

Root uses telematics to assess driving behavior and offers personalized rates based on individual driving habits. Safe drivers may benefit from lower premiums, making it an attractive option for those with good driving records.Lemonade

3. GEICO is a well-established insurer known for competitive rates

GEICO is a well-established insurer known for competitive rates and a wide range of coverage options. They offer various discounts and have a robust online platform for policy management.

4. Progressive offers a variety of coverage options and discounts

Progressive offers a variety of coverage options and discounts, including usage-based insurance programs that can benefit safe drivers. Their Snapshot program tracks driving habits to potentially lower premiums.

5. Insert image of the product

State Farm is a traditional insurer with a vast network of agents, offering personalized service and a range of insurance products. They provide various discounts and have a strong financial standing.

Benefits of Choosing Lemonade’s Auto Insurance

User-Friendly Digital Experience

Lemonade’s emphasis on technology results in a seamless digital experience, allowing customers to manage policies and file claims easily through their app. Autoinsurance.com+4Metromile+4NerdWallet: Finance smarter+4

Social Good Initiatives

A unique aspect of Lemonade’s model is its commitment to social good. The company allocates a portion of unclaimed premiums to charitable causes, allowing customers to contribute to organizations they care about through their insurance choices. Android Apps on Google Play

Use Cases: Problems Lemonade’s Auto Insurance Solves

Simplifying the Insurance Process

For tech-savvy individuals seeking a straightforward and digital-first insurance experience, Lemonade offers an intuitive platform that simplifies purchasing and managing auto insurance policies.

Personalized and Potentially Lower Premiums

Drivers who log fewer miles or exhibit safe driving behaviors may benefit from Lemonade’s personalized pricing models, potentially resulting in lower premiums compared to traditional insurers. Lemonade

How to Purchase Lemonade Auto Insurance

Purchasing a policy with Lemonade is a straightforward process:

- Visit the Website or Download the App: Access Lemonade’s services through their official website or mobile application.

- Enter Personal and Vehicle Information: Provide necessary details about yourself and your vehicle to receive a personalized quote.

- Customize Coverage: Adjust coverage options, limits, and deductibles to suit