Find the Best Deals and Coverage for 2025

When it comes to protecting your vehicle and finances, choosing the right car insurance is essential. In today’s market, consumers are bombarded with countless providers and policies, making it harder than ever to determine which one offers the best value. That’s where car insurance comparison tools come in.

By comparing policies side by side, you can save money, get better coverage, and ensure you’re not overpaying. This guide explores the best comparison platforms, how they work, their benefits, and how to use them to make smart financial decisions.

Why Car Insurance Comparison Matters

Understanding the Complexity of Car Insurance

Car insurance policies vary significantly between providers. Factors such as premiums, deductibles, coverage limits, customer service ratings, and additional perks make direct comparisons necessary. Without using a comparison tool, consumers may miss out on more affordable or better-suited options.

For instance, one provider might offer roadside assistance and rental coverage at no extra cost, while another may charge extra for the same features. By comparing multiple quotes and policy features at once, you’re in a better position to identify the best deal for your specific needs.

Benefits of Comparing Car Insurance

- Cost Savings: Users save up to 30% on average by switching after comparison.

- Tailored Coverage: Find plans that align closely with your driving habits and risk profile.

- Informed Decision-Making: Understand what’s included in each policy before committing.

- Time Efficiency: Save hours contacting individual providers by using one platform.

- Discount Discovery: Spot available discounts for bundling, good drivers, students, and more.

Top 5 Car Insurance Comparison Tools (2025)

Policygenius

Policygenius is a leading online insurance marketplace that provides side-by-side comparisons from major insurers like Progressive, GEICO, and Allstate. The platform uses an intuitive questionnaire to tailor results based on your location, vehicle, and driving record.

Why it stands out:

Policygenius offers transparency with detailed breakdowns of each policy, including coverage tiers and optional add-ons. It also features educational content to help new drivers and policyholders understand jargon and policy fine print.

Use Case: Ideal for new drivers or those unfamiliar with insurance terms who want a user-friendly experience without sacrificing accuracy.

Buy Button:

Compare Car Insurance on Policygenius

The Zebra

The Zebra allows users to compare over 100 insurance providers within minutes. With just your ZIP code and vehicle information, you get personalized quotes, which update in real-time.

Why it stands out:

Its speed and clean user interface make The Zebra a favorite among tech-savvy users. It also includes a “Zebra Score” to show the best-rated insurers based on claims handling and customer satisfaction.

Use Case: Ideal for time-constrained individuals who want quick yet comprehensive comparisons.

Buy Button:

Find Your Best Policy on The Zebra

Compare.com

Compare.com is one of the most comprehensive comparison sites, especially strong in offering real-time quotes from insurers who typically don’t list on aggregator platforms.

Why it stands out:

It connects users directly to insurer websites, allowing for seamless policy purchases after comparison. The platform even highlights which providers offer discounts for online purchases.

Use Case: Great for budget-conscious drivers looking to purchase immediately after comparing.

Buy Button:

Start Comparing with Compare.com

Insurify

Insurify uses AI-powered algorithms to deliver tailored car insurance recommendations. You’ll answer a few questions, and the system filters dozens of quotes within seconds.

Why it stands out:

Insurify uses proprietary data to highlight which insurers are best for different driver profiles (e.g., families, commuters, high-risk drivers).

Use Case: Perfect for users with complex driving histories or those looking for the best family plan.

Buy Button:

Compare Now on Insurify

Gabi

Gabi goes a step further by analyzing your existing car insurance policy and automatically searching for better alternatives. It functions as both a comparison tool and a policy manager.

Why it stands out:

You can upload your current policy, and Gabi will tell you if you’re overpaying. This saves time for users who already have coverage and are simply looking to reduce their premium.

Use Case: Ideal for current policyholders ready to switch or save.

Buy Button:

Let Gabi Review Your Policy

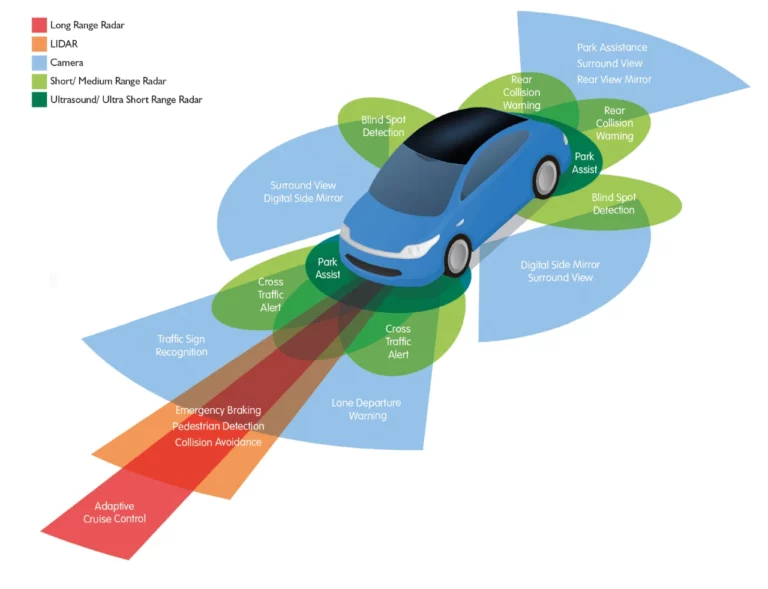

How Technology Enhances Car Insurance Comparison

Advanced Algorithms and Real-Time Data

Modern comparison tools are powered by advanced machine learning algorithms that fetch quotes in real-time based on your provided data. They also consider your driving history, vehicle condition, location, and preferences to match you with insurers most likely to offer you competitive rates.

This not only saves time but also increases the accuracy and relevance of your quotes.

Secure Data Encryption

All leading comparison platforms use high-end encryption to ensure your personal data is secure. As users often input sensitive information, these platforms are designed with privacy as a top priority.

Use Cases: How Car Insurance Comparison Tools Solve Real Problems

Problem: You’re Overpaying Without Knowing

Solution: Gabi analyzes your current bill and finds alternatives that offer equal or better coverage for a lower premium. Users often discover they’ve been overpaying by hundreds annually.

Problem: Too Many Options, Not Enough Time

Solution: The Zebra and Insurify deliver multiple quotes within minutes, making it easy to compare and decide without needing to visit each insurer’s website.

Problem: You’re a High-Risk Driver

Solution: Insurify’s AI algorithm evaluates your risk profile and finds insurers more lenient toward those with tickets or prior claims, ensuring you’re not penalized unfairly.

Problem: You’re New to Insurance

Solution: Policygenius walks you through each step, explaining every component of coverage, making it ideal for first-time buyers.

How to Buy and Where to Buy

Buying car insurance after comparison is simple and typically takes less than 10 minutes. After using any of the comparison tools listed above:

- Select the policy that best fits your needs and budget.

- Click on the provided link to be redirected to the insurer’s official website.

- Fill out the required information to finalize the purchase.

- Receive your policy documents via email instantly.

Recommended Links:

- Compare on Policygenius

- Search with The Zebra

- Start at Compare.com

- Insurify’s Platform

- Analyze with Gabi

FAQ

What is the best website to compare car insurance?

Policygenius and The Zebra are among the most trusted platforms due to their wide insurer networks, easy-to-use interfaces, and real-time quote capabilities.

Is it safe to enter my personal information on comparison websites?

Yes, leading comparison tools use encrypted connections and follow strict data protection policies to ensure your information remains secure.

How often should I compare car insurance rates?

Experts recommend comparing rates at least once a year or whenever your life circumstances change (e.g., moving, buying a new car, adding a driver).