Best Health Insurance Plans for Seniors in 2025

As individuals age, healthcare needs often become more complex, making comprehensive health insurance crucial. For seniors, especially those aged 65 and older, several health insurance options are available to ensure adequate coverage for medical services, prescription drugs, and other health-related expenses.

The primary health insurance options for seniors include:

- Medicare: A federal program providing health coverage for individuals 65 and older or those with certain disabilities.aflac.com+1verywellhealth.com+1

- Medicare Advantage (Part C): An alternative to Original Medicare offered by private insurers, often including additional benefits.hometeammo.com+13valuepenguin.com+13healthline.com+13verywellhealth.com+2investopedia.com+2valuepenguin.com+2

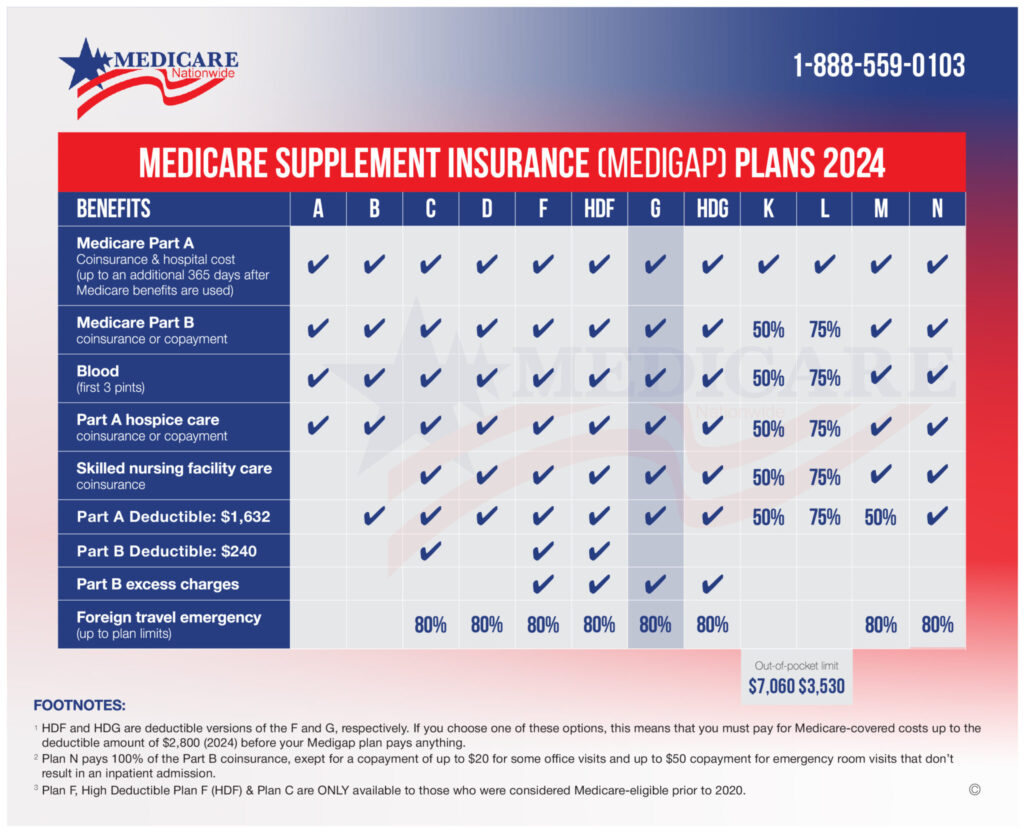

- Medigap (Medicare Supplement Insurance): Private insurance that helps cover costs not paid by Original Medicare.apnews.com+4healthline.com+4unbiased.com+4valuepenguin.com

- Medicaid: A state and federal program offering health coverage for low-income individuals, including some seniors.medicareseniorservices.com+2hometeammo.com+2aflac.com+2

Each option has its own set of benefits, costs, and eligibility requirements. Understanding these can help seniors make informed decisions about their healthcare coverage.hometeammo.com

Benefits of Comprehensive Health Insurance for Seniorsaflac.com+1hometeammo.com+1

Having robust health insurance coverage in retirement is essential for several reasons:

- Financial Protection: Health insurance helps mitigate the high costs of medical care, reducing out-of-pocket expenses for hospital stays, doctor visits, and prescription medications.

- Access to Preventive Services: Many plans cover preventive services like screenings and vaccinations, aiding in early detection and management of health conditions.

- Peace of Mind: Knowing that healthcare needs are covered allows seniors to enjoy retirement without the constant worry of unexpected medical bills.valuepenguin.com

- Comprehensive Care: Plans often include coverage for a wide range of services, including dental, vision, and hearing, which are crucial for maintaining quality of life.

Selecting the right health insurance plan ensures that seniors can access necessary medical services without compromising their financial stability.

Top Health Insurance Plans for Seniors in 2025reuters.com

AARP/UnitedHealthcare Medicare Advantage Plans

AARP, in collaboration with UnitedHealthcare, offers Medicare Advantage plans that combine Medicare Parts A and B, and often Part D, into a single plan. These plans may also include additional benefits like dental, vision, and wellness programs.healthline.com+3investopedia.com+3valuepenguin.com+3

Benefits:

- Comprehensive coverage beyond Original Medicare.investopedia.com

- Access to a broad network of healthcare providers.valuepenguin.com

- Additional services such as fitness programs and 24/7 nurse lines.valuepenguin.com+1thetimes.co.uk+1

Use Case:

Ideal for seniors seeking an all-in-one plan that covers hospital care, medical services, and prescription drugs, along with extra benefits.verywellhealth.com

How to Buy:

Explore AARP/UnitedHealthcare Medicare Advantage Plans

Medigap Plan G from Blue Cross Blue Shield

Medigap Plan G is a supplemental insurance plan that covers costs not paid by Original Medicare, such as copayments, coinsurance, and deductibles. Blue Cross Blue Shield offers this plan with a wide network of providers.valuepenguin.com

Benefits:

- Predictable out-of-pocket costs.

- Freedom to choose any doctor or hospital that accepts Medicare.healthcare.gov+4investopedia.com+4unbiased.com+4

- No network restrictions.investopedia.com

Use Case:

Suitable for seniors who prefer Original Medicare but want additional coverage to minimize unexpected expenses.valuepenguin.com

How to Buy:

Learn More About Medigap Plan G

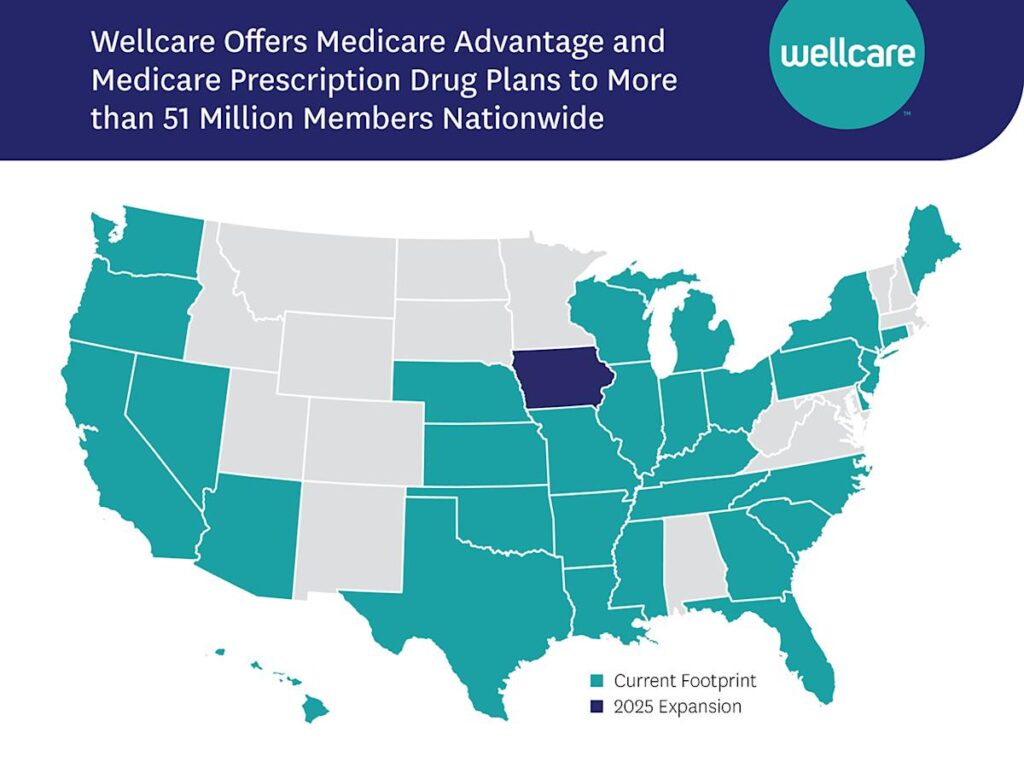

Wellcare Medicare Part D Prescription Drug Plans

Wellcare offers standalone Medicare Part D plans that provide prescription drug coverage, essential for seniors managing chronic conditions requiring medication.

Benefits:

- Affordable monthly premiums.

- Coverage for a wide range of prescription medications.

- Access to a large network of pharmacies.

Use Case:

Best for seniors enrolled in Original Medicare who need comprehensive prescription drug coverage.

How to Buy:

Kaiser Permanente Medicare Advantage Plans

Kaiser Permanente offers Medicare Advantage plans with integrated care models, combining healthcare services and insurance coverage under one roof.

Benefits:

- Coordinated care with Kaiser Permanente physicians.

- Additional benefits like vision, dental, and hearing coverage.investopedia.com+1reuters.com+1

- Emphasis on preventive care and wellness programs.

Use Case:

Ideal for seniors who value integrated healthcare services and coordinated care teams.

How to Buy:

Explore Kaiser Permanente Medicare Plans

Aetna Medicare Supplement Insurance Plans

Aetna offers Medicare Supplement Insurance (Medigap) plans that help cover out-of-pocket costs not paid by Original Medicare, providing financial predictability.

Benefits:

- Multiple plan options to suit different needs and budgets.

- Nationwide coverage with any Medicare-accepting provider.

- No referrals required to see specialists.seopital.co+2investopedia.com+2investopedia.com+2

Use Case:

Suitable for seniors seeking flexibility in choosing healthcare providers and minimizing unexpected medical expenses.

How to Buy:

View Aetna Medicare Supplement Plans

Frequently Asked Questionshealthline.com+7unbiased.com+7healthcare.gov+7

1. What is the difference between Medicare Advantage and Medigap plans?

Medicare Advantage plans (Part C) are all-in-one plans offered by private insurers that include Medicare Parts A and B, and often Part D, along with additional benefits. Medigap plans, on the other hand, supplement Original Medicare by covering out-of-pocket costs like copayments and deductibles but do not include prescription drug coverage.healthline.com+5valuepenguin.com+5investopedia.com+5investopedia.com+1valuepenguin.com+1

2. Can I have both Medicare Advantage and Medigap coverage?

No, you cannot have both Medicare Advantage and Medigap coverage simultaneously. If you choose a Medicare Advantage plan, you cannot enroll in a Medigap plan, and vice versa.valuepenguin.com+2unbiased.com+2investopedia.com+2

3. How do I choose the best health insurance plan as a senior?

Consider factors such as your healthcare needs, preferred doctors and hospitals, prescription medications, and budget. Compare the benefits, costs, and provider networks of available plans to determine which best aligns with your individual requirements.